Auto Loan Rates In Arkansas

As we look towards making major purchases such as a new vehicle, one of the most important factors to consider is the auto loan rate. An auto loan rate refers to the percentage of interest that will be charged on the amount borrowed to finance your vehicle. It's important to choose an auto loan rate that is not only favorable but also affordable. In this article, we'll explore everything you need to know about auto loan rates, and how to find the best one for you.

What factors determine auto loan rates?

The process of determining the auto loan rate involves several factors, including borrower credit score, loan term, and the type of vehicle being financed.

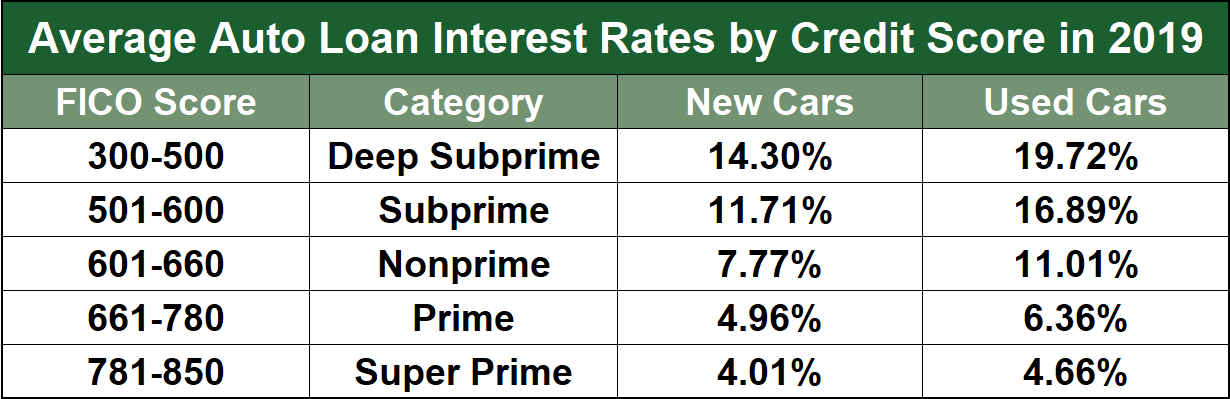

Credit score is one of the most important factors for determining auto loan rates. A higher credit score often translates to more favorable loan terms and interest rates. On the other hand, lower credit scores may lead to less favorable terms, including higher interest rates and larger down payments.

Loan term is another factor that affects auto loan rates. The loan term refers to the time period over which the loan must be repaid. Longer loan terms often come with higher interest rates since the borrower will be making payments over a longer period of time.

The type of vehicle being financed is also a factor in determining auto loan rates. Newer and more expensive vehicles often result in higher interest rates compared to used or older vehicles.

How to find the best auto loan rate?

When it comes to finding the best auto loan rate, there are several steps to follow:

1. Check your credit score: The first step is to check your credit score and ensure that there are no errors on your credit report. If there are errors, take the necessary steps to correct them before applying for an auto loan.

2. Shop around for rates: It's essential to shop around and compare rates from different lenders before deciding on a loan. This gives you a better idea of what rates are available and allows you to make an informed decision.

3. Consider credit unions: Credit unions are non-profit financial cooperatives that offer favorable loan terms and lower interest rates compared to traditional banks. Consider joining a credit union and checking their auto loan rates before applying for a loan.

4. Negotiate: Once you've found a loan that meets your needs, consider negotiating with the lender for better terms or interest rates. This could help you save money on your auto loan over time.

Conclusion

In conclusion, auto loan rates are an essential factor to consider when purchasing a new vehicle. Higher auto loan rates can add significant costs to the overall purchase price of a vehicle, so it's important to shop around for the best possible rate. Consider checking your credit score, shopping around for rates from different lenders, joining a credit union and negotiating for better loan terms to make a well-informed decision.

Investment Philosophy

Investing is an integral part of ensuring long-term financial success. Whether you're just starting or are an experienced investor, understanding the investment philosophy is essential to making informed decisions that maximize returns while minimizing risks.

What is investment philosophy?

Investment philosophy refers to the beliefs or principles that guide an investor's decision-making process. It's the approach that an investor takes towards investing, and it influences the types of investments that they make and the strategies that they employ.

There are several different investment philosophies, including:

1. Value investing: Value investing involves looking for undervalued stocks or assets that have the potential to increase in value over time. This philosophy emphasizes a long-term perspective and focuses on the fundamentals of the underlying asset.

2. Growth investing: Growth investing involves investing in companies that have the potential for above-average growth in earnings and revenue. This philosophy typically involves investing in newer or smaller companies that show strong potential for growth in their industry or market.

3. Index investing: Index investing involves investing in a broad portfolio of stocks that track a particular market index, such as the S&P 500. This strategy is popular with investors who prefer a passive approach to investing and who want to minimize costs associated with active management.

How to choose an investment philosophy?

When it comes to choosing an investment philosophy, there are several key factors to consider:

1. Risk tolerance: Your risk tolerance is a critical factor when choosing an investment philosophy. If you're comfortable with risk, you may be more inclined towards a growth or value investing strategy. If you'd rather have a more conservative approach, index investing may be a better fit.

2. Time horizon: Your time horizon, or the length of time that you plan on holding your investments, is another important factor. If you're a long-term investor, value investing or growth investing may be more appropriate since these approaches tend to focus on the long-term potential of an investment. For short-term investors, index investing or other passive strategies may be a better fit.

3. Diversification: Diversification, or spreading your investments across multiple sectors, is essential to minimize risk. Consider an investment philosophy that allows for diversification across multiple asset classes and industries.

Conclusion

Choosing an investment philosophy is an essential step in building a successful investment portfolio. Understanding your risk tolerance, time horizon, and the importance of diversification are all critical factors that can guide your decision-making process. Consider taking a long-term approach to investing and explore different strategies like value, growth or index investing to create a portfolio that aligns with your investment goals.

If you are searching about Competitive Loan Rates - America First Credit Union you've visit to the right place. We have 7 Pics about Competitive Loan Rates - America First Credit Union like romancodesign: 650 Credit Score Auto Loan Rate, Arkansas Federal Credit Union Auto Loan Rates and also Arkansas Federal Credit Union Auto Loan Rates. Here it is:

Competitive Loan Rates - America First Credit Union

www.americafirst.com

www.americafirst.com Investment Philosophy – Latticework Investing

latticeworkinvesting.com

latticeworkinvesting.com loan auto rates interest month via

Arkansas Federal Credit Union Auto Loan Rates

bdteletalk.com

bdteletalk.com Romancodesign: 650 Credit Score Auto Loan Rate

romancodesign.blogspot.com

romancodesign.blogspot.com loan creditrepair interest afford

Auto Loan Rates - Arizona Central Credit Union

www.azcentralcu.org

www.azcentralcu.org rates

What Are The Current Auto Loan Rates In Texas?

www.texastechfcu.org

www.texastechfcu.org rate

3 Auto Loans For Bad Credit - (2020's Best Reviews)

www.badcredit.org

www.badcredit.org auto rates loans interest loan credit score car bad cars used occurs reasons starting lower couple

What are the current auto loan rates in texas?. Loan creditrepair interest afford. Romancodesign: 650 credit score auto loan rate

Post a Comment for "Auto Loan Rates In Arkansas"