Fha Loan 是 什么

What is an FHA loan?

An FHA loan is a mortgage loan that's backed by the Federal Housing Administration. This means that if you default on the loan, the FHA will pay the lender to help them recover their losses. Because of this, FHA loans have lower down payment requirements and more flexible credit score requirements than conventional loans.

How do you qualify for an FHA loan?

While FHA loans have more lenient requirements than conventional loans, there are still certain criteria that you must meet in order to qualify. Here are some of the main things that the FHA looks at:

- Credit score: The FHA doesn't have a minimum credit score requirement, but most lenders will require a score of at least 500. However, in order to qualify for the lowest down payment (3.5%), you'll typically need a score of at least 580.

- Debt-to-income ratio: This is the amount of your monthly income that goes towards paying off debt. The FHA generally looks for a debt-to-income ratio of no more than 43%, although some lenders may be willing to go higher in certain cases.

- Income: You'll need to provide proof of your income, usually in the form of pay stubs or tax returns. The FHA requires that your total debt payments (including your mortgage) don't exceed 31% of your gross monthly income.

- Employment history: You'll need to show that you have a steady source of income, typically by providing at least two years of employment history. If you're self-employed, you'll need to provide additional documentation such as profit and loss statements.

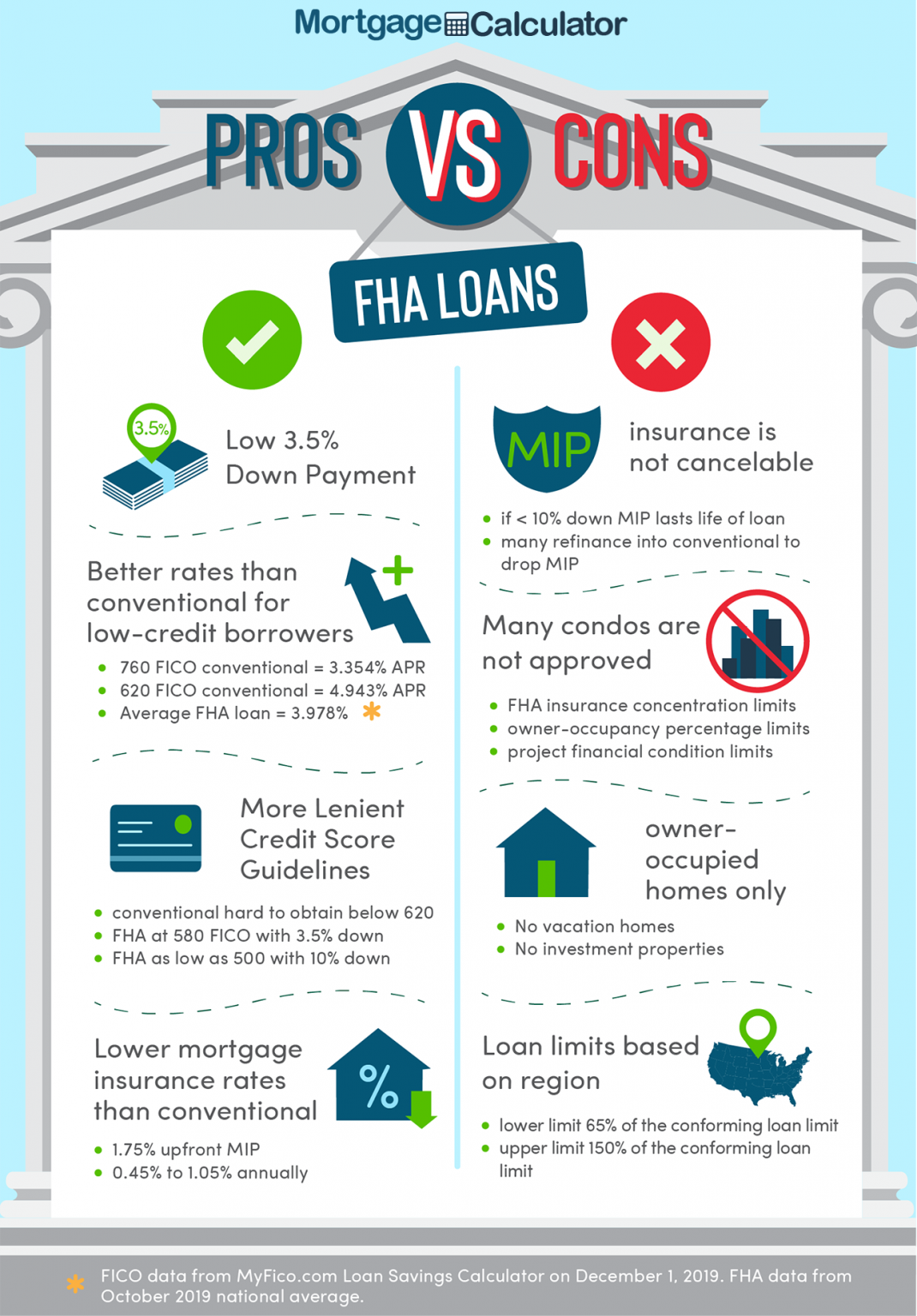

What are the benefits of an FHA loan?

Here are some of the main advantages to consider:

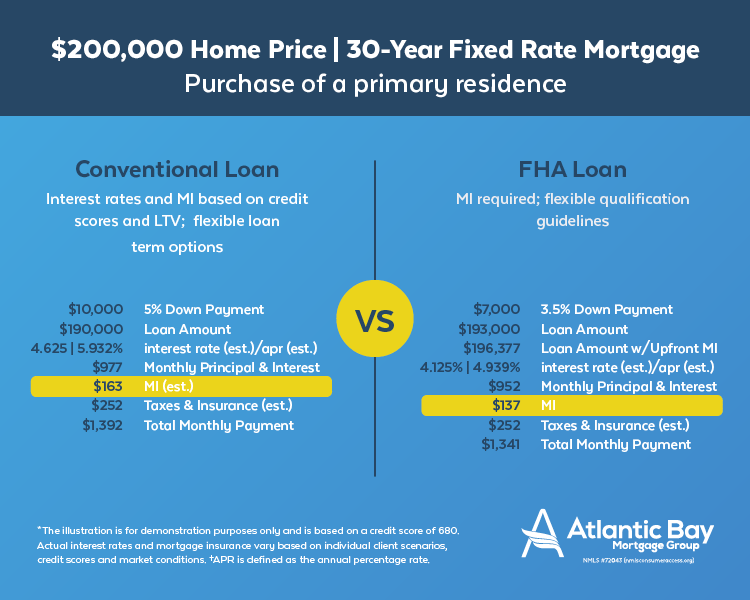

- Lower down payment requirements: With an FHA loan, you can put down as little as 3.5% of the purchase price. This can make it easier to buy a home, especially if you don't have a lot of savings.

- More flexible credit requirements: While most lenders require a credit score of at least 620 for a conventional loan, you can often qualify for an FHA loan with a lower score. This can be a good option if you're still working on improving your credit.

- Assumable: FHA loans are assumable, which means that if you sell your home, the buyer can take over your mortgage at your current interest rate. This can be a good selling point if interest rates have gone up since you got your loan.

- No prepayment penalty: Some loans charge a fee if you pay off your loan early, but FHA loans don't have a prepayment penalty. This means that if you come into some extra money and want to pay off your loan early, you won't be charged a fee.

What are the drawbacks of an FHA loan?

While there are some definite benefits to an FHA loan, there are also some potential drawbacks to keep in mind:

- Mortgage insurance: Because FHA loans are more risky for lenders, they require borrowers to pay mortgage insurance premiums (MIP). This adds to the overall cost of your loan and can't be cancelled in most cases.

- Lower loan limits: FHA loans have a maximum loan limit that varies depending on the area. In some cases, this may be lower than what you need to buy a home in your desired location.

- Refinancing can be difficult: If you have an FHA loan and want to refinance to a conventional loan with a lower interest rate, you may have to pay off your existing loan in full before you can do so. This can be a challenge if you don't have a lot of equity in your home yet.

Is an FHA loan right for you?

Ultimately, whether or not an FHA loan is a good fit for you will depend on your individual circumstances. Here are a few things to consider:

- Do you have a low credit score or limited savings? If so, an FHA loan may be a good option to help you get into a home.

- Do you plan on staying in your home for a long time? If not, the mortgage insurance premiums may make an FHA loan more expensive than a conventional loan in the long run.

- Do you need to borrow more than the FHA loan limit in your area? If so, you'll need to look into other loan options.

If you're interested in learning more about FHA loans and whether they're a good fit for you, we recommend speaking with a mortgage lender or financial advisor. They can help you understand your options and make the best decision for your unique situation.

If you are searching about Do I Qualify for an FHA Loan? – 7 Sins Game you've visit to the right page. We have 7 Pics about Do I Qualify for an FHA Loan? – 7 Sins Game like 5 FHA Loan Drawbacks | Millionacres, Do I Qualify for an FHA Loan? – 7 Sins Game and also What Is An FHA Loan And How Do You Qualify. Here it is:

Do I Qualify For An FHA Loan? – 7 Sins Game

7sins-game.com

7sins-game.com fha loan mortgage limits pros qualify benefits maximum approved conventional calculation qualification fico fidelity conforming

FHA Loans Explained By ZFG Mortgage

www.zfgmortgage.com

www.zfgmortgage.com fha loan mortgage loans rates conventional apply guidelines federal criteria government work explained process program insurance housing benefits hud works

What Is An FHA Loan And How Can I Qualify? | LowerMyBills

www.lowermybills.com

www.lowermybills.com fha qualify loans lowermybills

5 FHA Loan Drawbacks | Millionacres

www.fool.com

www.fool.com fha loan drawbacks loans financing millionacres

Is An FHA Or Conventional Loan Your Best Financing Option?

www.sellingmyrtlebeach.com

www.sellingmyrtlebeach.com fha loan holding hand money illustration conventional financing option vector cash loans buyers inspections appraisal poster house

What Is An FHA Loan And How Do You Qualify

www.ithinkrealty.com

www.ithinkrealty.com fha loan qualify information interested currently homes if

What You Need To Know About The FHA Loan

www.atlanticbay.com

www.atlanticbay.com fha loan requirements down payment credit score need know low

Is an fha or conventional loan your best financing option?. Do i qualify for an fha loan? – 7 sins game. What is an fha loan and how can i qualify?

Post a Comment for "Fha Loan 是 什么"