Gpo Auto Loan Rates

When it comes to buying a car, one of the most important factors to consider is the interest rate on your loan. If you have a credit score of 600, you may be wondering what kind of interest rates you should expect to pay. In this post, we'll take a look at the average interest rates for car loans with a 600 credit score and explore some ways you can improve your credit score to get a better rate. First, let's talk about what your credit score means. Your credit score is a number that reflects your creditworthiness, or how likely you are to pay back your debts on time. The higher your credit score, the more likely you are to be approved for loans with favorable interest rates. A credit score of 600 is considered fair, which means you may have some negative marks on your credit report but still have a decent chance of being approved for a loan. However, you can expect to pay higher interest rates than someone with a higher credit score. According to data from LendEDU, the average interest rate for a used car loan with a credit score of 600 is around 11.27%. For a new car loan, the average rate is slightly lower at 10.17%. These rates are higher than the national average for car loans, which is around 4.21% for a used car and 3.65% for a new car. If you have a credit score of 600 and are in the market for a car loan, there are a few things you can do to improve your chances of getting a better interest rate. Here are some tips: 1. Check your credit report for errors Before applying for a car loan, it's important to check your credit report to make sure there are no errors or inaccuracies that could be dragging down your score. If you do find errors, you can dispute them with the credit bureau to have them removed. 2. Pay down your existing debts If you have high balances on your credit cards or other loans, it can negatively impact your credit score. By paying down your debts, you can improve your credit utilization ratio, which is a factor that lenders consider when determining your creditworthiness. 3. Consider a cosigner If you're having trouble getting approved for a car loan with a 600 credit score, you may want to consider finding a cosigner with a higher credit score. This can improve your chances of getting approved and getting a better interest rate. 4. Shop around for the best deal Don't just accept the first car loan offer you receive. Be sure to shop around and compare rates from multiple lenders to find the best deal. You may also want to consider working with a credit union or community bank, as they may be more willing to work with borrowers with lower credit scores. Now that we've covered some tips for getting a better interest rate with a 600 credit score, let's take a look at some of the best car loan rates available right now. First up, we have a car loan from Capital One. This loan is available for both new and used cars and has a starting interest rate of 3.99% APR. You'll need a credit score of at least 500 to be eligible for this loan. Next, we have a car loan from LightStream. This loan is only available for new car purchases and has a starting interest rate of 2.49% APR. However, you'll need a credit score of 660 or higher to be eligible for this loan. If you're looking to refinance an existing car loan, you may want to consider a loan from PenFed Credit Union. This loan has a starting interest rate of 1.49% APR and is available for both new and used car refinancing. You'll need a credit score of at least 700 to be eligible for this loan. When it comes to getting a car loan with a 600 credit score, it's important to be aware of the higher interest rates you may be facing. However, with these tips and some careful shopping around, you can still find a good deal on a car loan that fits your budget.  epicsidegigs.com

epicsidegigs.com  classiccarwalls.blogspot.com

classiccarwalls.blogspot.com  www.lexingtonlaw.com

www.lexingtonlaw.com  www.creditrepair.com

www.creditrepair.com  www.americafirst.com

www.americafirst.com  lendedu.com

lendedu.com  www.sappscarpetcare.com

www.sappscarpetcare.com

If you are looking for Car Loan Rates - 10 Best Auto Loan Rates (Guide for 2020) you've came to the right place. We have 7 Pictures about Car Loan Rates - 10 Best Auto Loan Rates (Guide for 2020) like Car Loan Interest Rate For 600 Credit Score - Classic Car Walls, Auto Loan Rates: Used, New, and Refinance | LendEDU and also Competitive Loan Rates - America First Credit Union. Here you go:

Car Loan Rates - 10 Best Auto Loan Rates (Guide For 2020)

epicsidegigs.com

epicsidegigs.com loan rates car guide auto

Car Loan Interest Rate For 600 Credit Score - Classic Car Walls

classiccarwalls.blogspot.com

classiccarwalls.blogspot.com approval dealerships lots

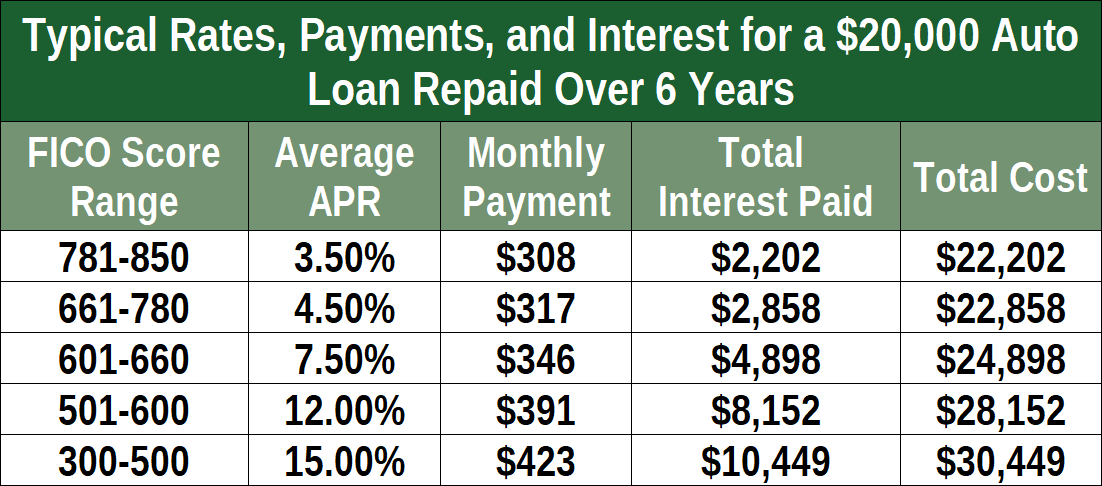

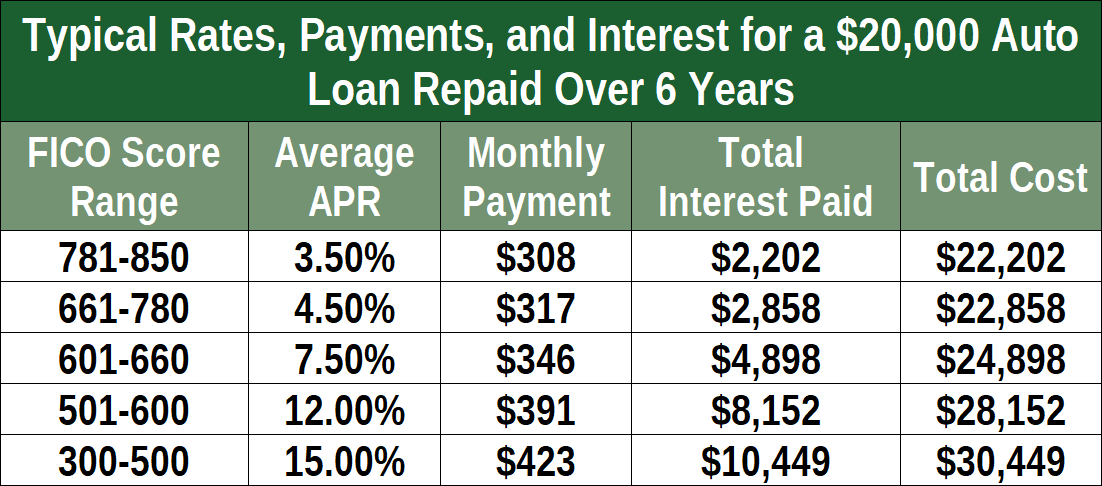

Average Auto Loan Rates By Credit Score | Lexington Law

www.lexingtonlaw.com

www.lexingtonlaw.com Average Auto Loan Rates | Credit Repair

www.creditrepair.com

www.creditrepair.com loan credit rates auto car average score standards regarding disclosure editorial

Competitive Loan Rates - America First Credit Union

www.americafirst.com

www.americafirst.com Auto Loan Rates: Used, New, And Refinance | LendEDU

lendedu.com

lendedu.com loan lendedu rates auto

Current Auto Loan Rates Utah

www.sappscarpetcare.com

www.sappscarpetcare.com rates current auto loan utah

Approval dealerships lots. Auto loan rates: used, new, and refinance. Average auto loan rates by credit score

Post a Comment for "Gpo Auto Loan Rates"