Usda Loans Richmond Ky

Are you looking to buy a new home in a rural area but struggling to find the right financing option? Don't worry, we're here to help. One great option to consider is a USDA loan. Here's everything you need to know:

What is a USDA loan?

A USDA loan is a mortgage loan offered by the United States Department of Agriculture to help individuals or families purchase homes in rural areas. The goal of USDA loans is to promote home ownership in rural areas by providing affordable financing options for those who may not qualify for traditional mortgage loans.

To qualify for a USDA loan, the property in question must be located in a designated rural area. The USDA defines "rural area" as any area that is not located in a city, town or suburban area that has a population of more than 10,000 people. This means that many suburban areas may still be eligible for USDA loans.

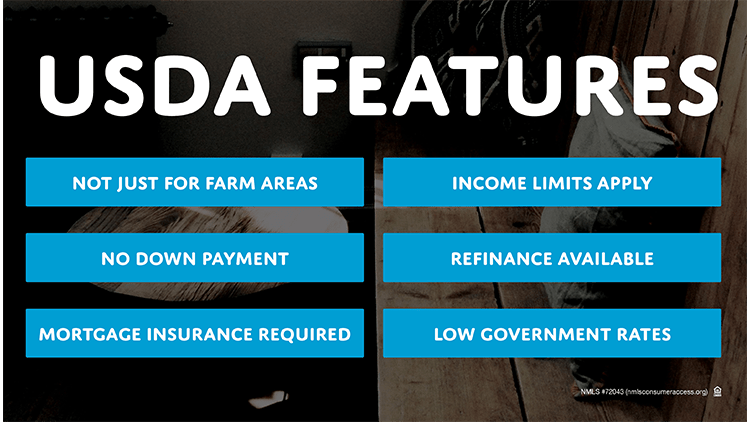

What are the benefits of a USDA loan?

One of the biggest benefits of USDA loans is that they require no down payment. This means that you can purchase a home with 100% financing. Additionally, USDA loans offer competitive interest rates and flexible credit requirements. This makes them an affordable and accessible option for many home buyers.

Another benefit of USDA loans is that they are available to both first-time and repeat home buyers. This means that no matter where you are in the home buying process, a USDA loan may be right for you.

What types of USDA loans are available?

There are two main types of USDA loans: guaranteed and direct loans. Guaranteed loans are offered by approved lenders and backed by the USDA. Direct loans are offered by the USDA itself.

Guaranteed loans are the most common type of USDA loan. They are available to individuals or families with moderate incomes who are looking to purchase homes in rural areas. Guaranteed loans have more flexible credit requirements than traditional mortgage loans, making them a great option for those with less-than-perfect credit.

Direct loans are available to individuals or families with low incomes who are unable to secure financing through other channels. These loans are designed to provide affordable housing options for those who may otherwise be unable to obtain home ownership. Direct loans come with some income eligibility requirements and may be subject to subsidy payments based on income.

How do I apply for a USDA loan?

The first step to applying for a USDA loan is to determine if the property you are interested in is located in a designated rural area. You can use the USDA's online map tool to check if a specific address is eligible.

Once you have determined that the property is eligible, you will need to find a lender who is approved to offer USDA loans. You can search for approved lenders on the USDA's website or by contacting your local Rural Development office.

When you apply for a USDA loan, you will need to provide documentation of your income, assets, and credit history. The specific requirements may vary depending on the type of loan you are applying for and the lender's individual requirements. Be sure to ask your lender for a complete list of required documentation before you begin the application process.

Are there any fees associated with USDA loans?

Like any mortgage loan, USDA loans come with some fees. However, these fees may be lower than those associated with traditional mortgage loans. USDA loans do not require a down payment, which saves you the cost of a down payment. Additionally, USDA loans do not require mortgage insurance, which can save you thousands of dollars over the life of your loan.

However, there may be a one-time upfront fee associated with USDA loans. This fee is currently 1% of the loan amount and can be rolled into the loan. There may also be an annual fee equal to 0.35% of the loan amount. This fee is paid in monthly installments and is calculated based on the outstanding principal balance of the loan.

Are there any restrictions on what I can use a USDA loan for?

USDA loans can be used to purchase single-family homes, townhouses, and condos located in eligible rural areas. The loan can also be used to make certain improvements or repairs to an existing home. However, USDA loans cannot be used to purchase investment properties or vacation homes.

In conclusion,

If you are looking to purchase a home in a rural area, a USDA loan may be the right financing option for you. With no down payment required, flexible credit requirements, and affordable rates, USDA loans make home ownership in rural areas achievable for many individuals and families. Be sure to research all of your options and speak with an approved lender to determine if a USDA loan is right for you.

We hope that this information has been helpful in your search for the right financing option for your home purchase. Remember to always do your research and choose the financing option that is right for your unique situation. Good luck!

If you are searching about USDA Loans you've visit to the right web. We have 7 Pics about USDA Loans like USDA Loans, What Is The Mortgage Insurance Premium On A Kentucky Rural Housing USDA and also 19 Frequently Asked Questions About USDA Loans in CT. Here you go:

USDA Loans

www.loans101.com

www.loans101.com usda loan eligibility qualify

Kentucky USDA Rural Housing Mortgage Lender: Difference Between 502

kentuckyruralhousingusdaloan.blogspot.com

kentuckyruralhousingusdaloan.blogspot.com loan usda direct guaranteed rhs down between difference guarantee kentucky money loans rural purchasing housing section program differences programs buying

USDA Loan Benefits & Requirements - Blog | USA Mortgage

missourimortgagesource.com

missourimortgagesource.com usda loan loans benefits financing mortgage choose board

6 Things You Should Know About The USDA Loan

www.atlanticbay.com

www.atlanticbay.com usda loans loan know should things payment down there

Everything You Need To Know About USDA Loans | Seedcopa

seedcopa.com

seedcopa.com usda loans loan program package details rural helping buyers afford homes everything need know announces farmers support

What Is The Mortgage Insurance Premium On A Kentucky Rural Housing USDA

kyfirsttimehomebuyer.wordpress.com

kyfirsttimehomebuyer.wordpress.com usda mortgage loans

19 Frequently Asked Questions About USDA Loans In CT

bluewatermtg.com

bluewatermtg.com usda

Usda mortgage loans. Usda loans loan program package details rural helping buyers afford homes everything need know announces farmers support. Everything you need to know about usda loans

Post a Comment for "Usda Loans Richmond Ky"